Joint account for couples – the next step in your relationship

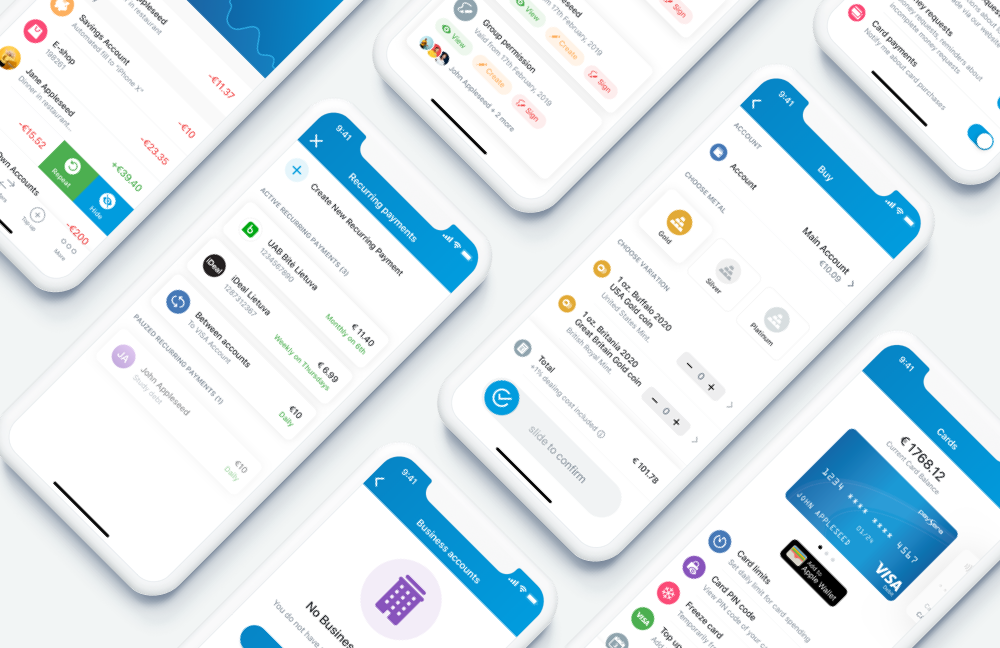

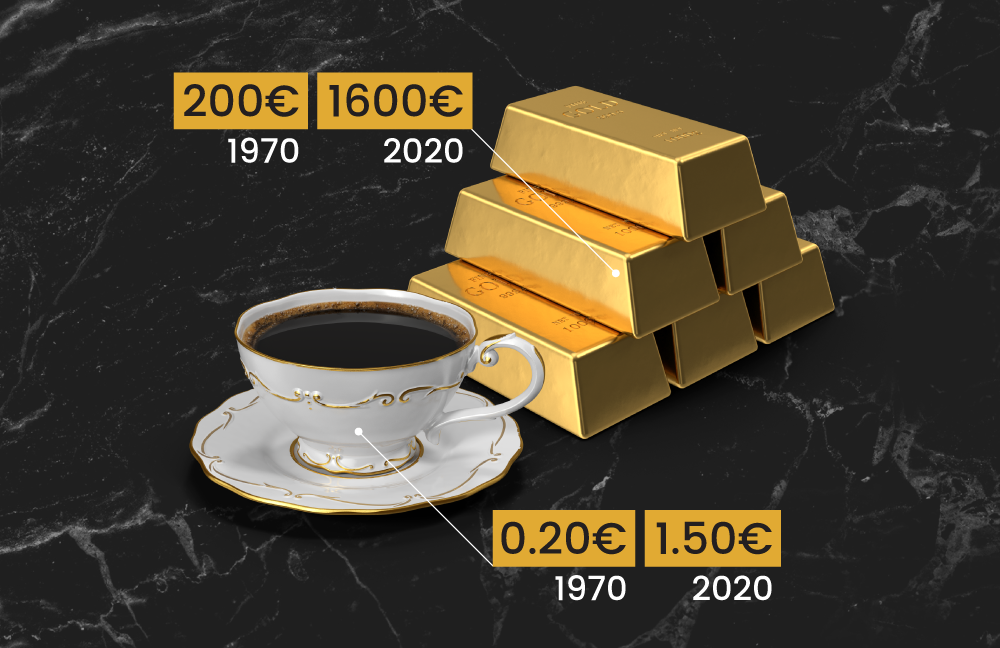

Shared accommodation, shared car, shared household – all of this often means shared family finances. And since financial technologies are rapidly getting better, shared expenses and savings for couples increasingly become the norm, and young couples no longer need to awkwardly remind their partners about unpaid utilities or rent. Features like joint accounts, shared savings, or money requests not only bring more transparency but can even save a romantic relationship.

Does talking about money ruin the mood?

Apparently even the closest couples that share secrets, memories, and hopes feel awkward when it comes to money-talk. Therefore couples often have separate finances all the way until their marriage or their first child.

However, a partner's financial habits – their views on spending control and savings, is an aspect that is best to be made clear early in the relationship. Every year surveys signal that disagreements over finances are some of the most common reasons for domestic conflicts and often lead to divorce or break ups. Meanwhile, couples that openly discuss their money issues tend to have a happier and more peaceful relationship.

Will you... open a joint account with me? 💍

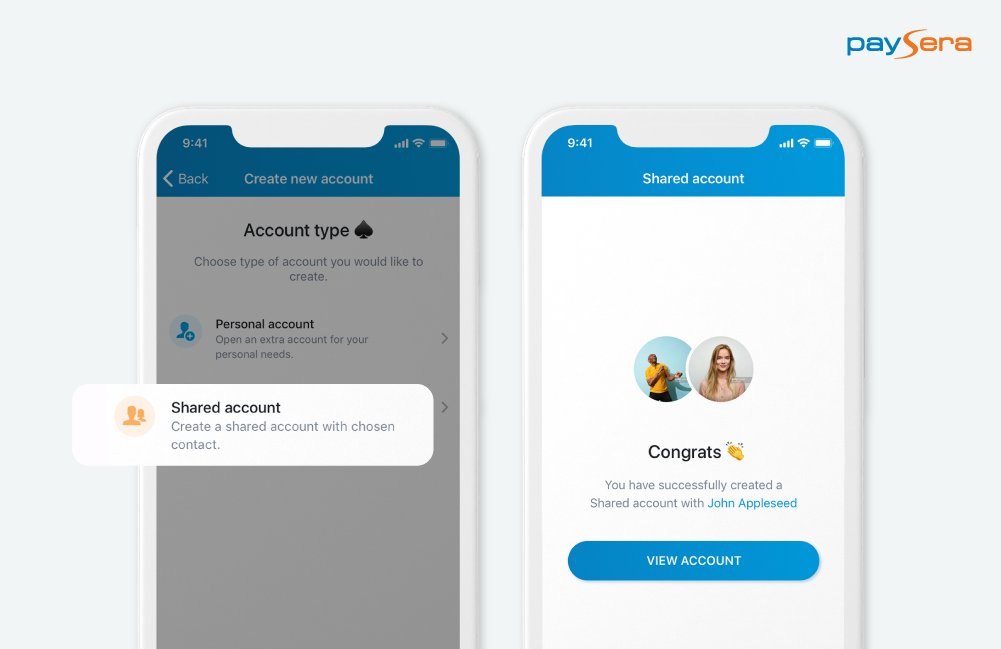

One of the ways to combine family finances – opening a joint account. In traditional banks, a couple often opens an account where both of the parties hold equal powers over funds and permissions – both partners can close the account, etc. Meanwhile, when you open a shared account in the Paysera mobile app – one person is the main owner of the account and they share the permissions with the partner to control the funds together – but only one can close the account.

In order to open a joint account in Paysera – both people must have personal Paysera accounts. Accounts can be opened free of charge. Then, log in to the Paysera app and press on your profile icon> My accounts> Create new account> Shared account. Come up with an account name and choose the person who you will be sharing this account with (your contact will be able to access the account in 12 hours).

During the previous year (2020) around 5000 private clients shared their Paysera account with someone else. This practice is way more common among business account holders, but the demand is increasing for such features in day-to-day finance management also

Not ready for a shared account? Use alternatives 🤝

If you don't feel ready to bring up that crucial shared account question just yet – use other alternative features that might help you split shared expenses.

Split bill feature ✂️

You just paid for a large grocery shopping? Or maybe you covered rent and utilities? Not the first time in a row? If both you and your partner (or maybe just a friend) have aPaysera account – swipe left on a recent transaction> press Split bill and choose the person with whom you would like to split it. You can pay equal parts or in any proportion of your choice.

Your partner will instantly receive a notification about the suggestion to split the bill and they can accept it in one tap. Or they can also decline it...

Money request feature 💸

If your latest expenses were in cash or from another bank account – instead of splitting an existing bill you can casually send a money request. Log in to the app> Transfers> Request money> Choose a contact and an amount.

This way it is impossible to forget that you owe someone money – you will see the reminder until you decline or accept the request. And vice versa.

Shared savings 🐷

Finally, even if you have separate expenses, maybe you are saving for a common goal? Consider opening a shared account for savings. You will be able to set recurring payments from your main account and you won't even notice how you suddenly collect enough money for a new car or a wedding💒.

In the app press More> Savings> Create new savings> Come up with a name> Goal> And invite somebody to save together.

So, as dull as it might sound, money talk with your loved ones is a must in a healthy relationship. And so it happens that financial technologies really make this almost seamless. You don't use the Paysera app to manage your finances? You are missing out. Read more about it.