Paysera Selects iPiD as a Strategical Partner for VoP Compliance and for Global Account Verification

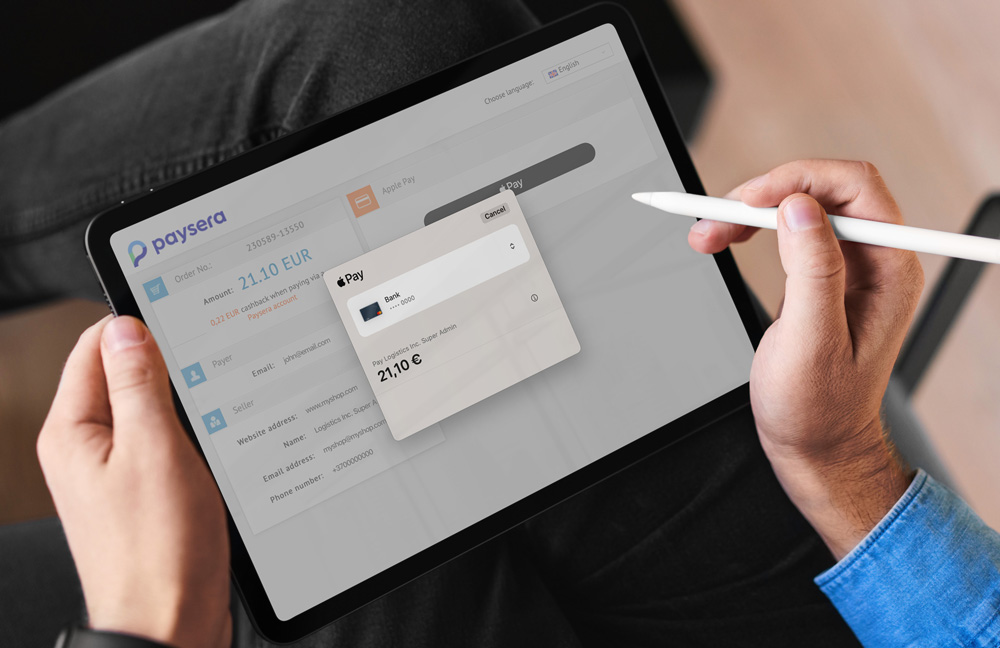

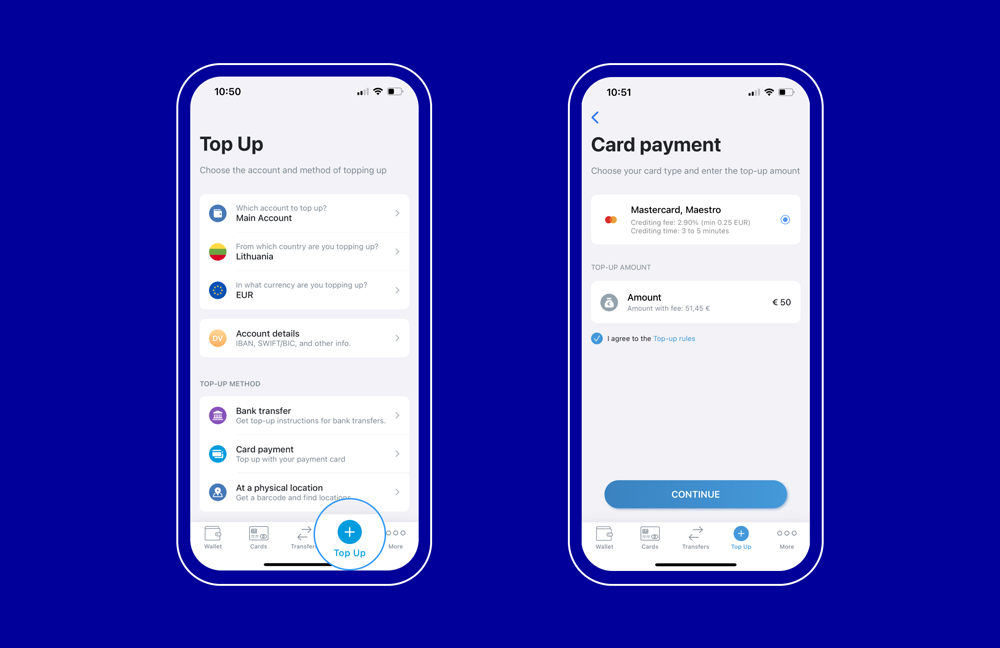

Paysera, a financial technology company with 20 years of market experience, has announced a strategic partnership with iPiD, a global provider of payee verification solutions. This collaboration aims to strengthen Paysera's Know Your Payee (KYP) processes and ensure compliance with new EU regulations requiring financial institutions to verify payee details before processing transfers in euros.